Key Takeaways:

➡️ DSCR loans focus on property’s income, not personal income, making them ideal for investors with non-traditional income sources or high DTI (Debt to Income) ratios if they already own investment properties.

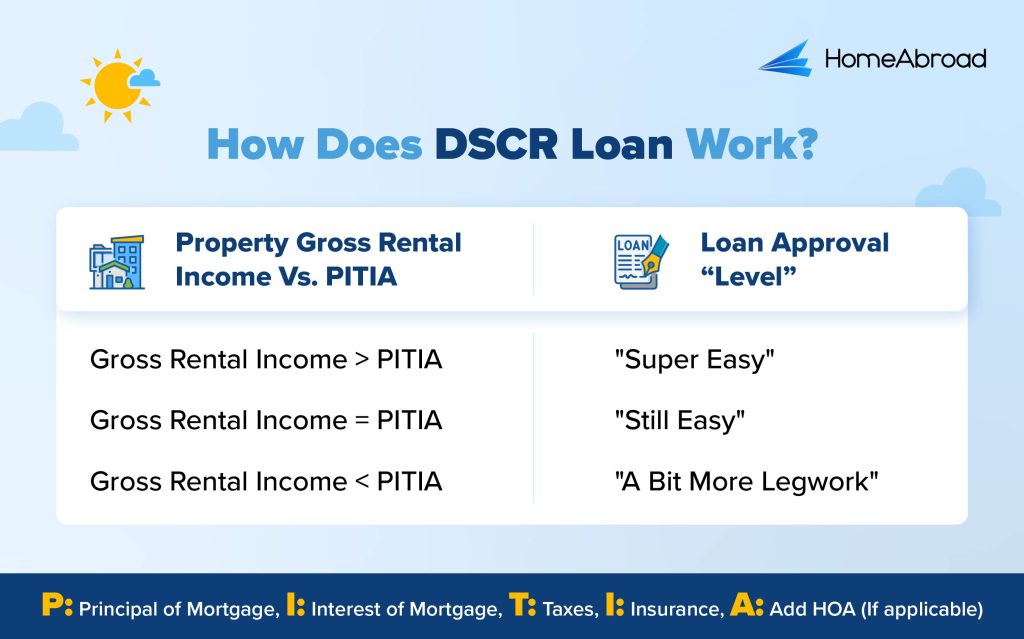

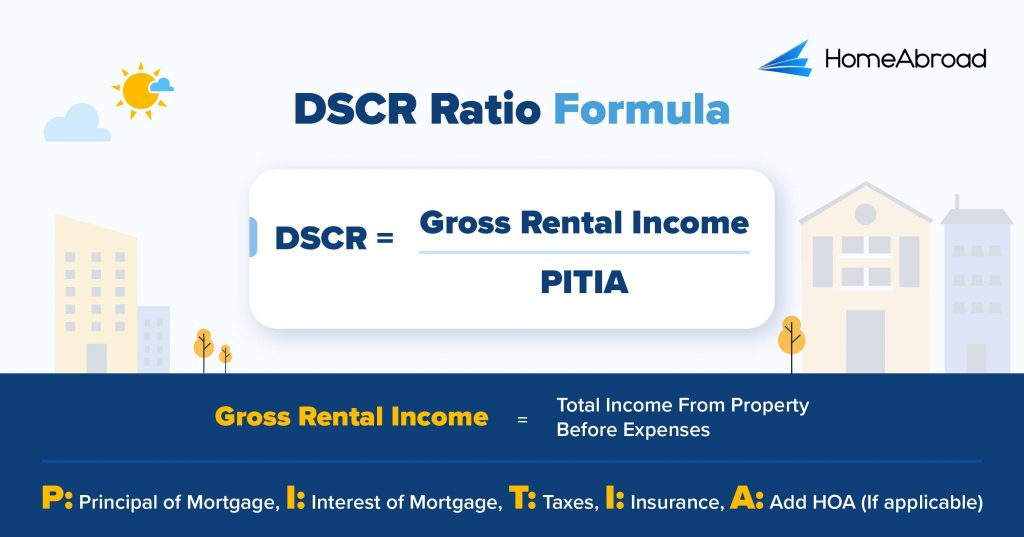

➡️ DSCR (Debt Service Coverage Ratio) is the ratio of gross rental income to PITIA (Principal, Interest, Taxes, Insurance, HOA).

➡️ Generally, to qualify for a DSCR loan, the property should make enough income to pay for its debt service, i.e. PITIA.

➡️ Foreign investors can qualify for a DSCR loan without needing a US credit history.

Over the years, I’ve helped countless real estate investors secure financing tailored to their goals. One question consistently arises:

How can I grow my portfolio without relying on my personal income or tax returns?

The answer is DSCR loans—a financing tool specifically designed for real estate investors. These loans prioritize the property’s rental income over the borrower’s personal financial profile, simplifying the approval process and enabling faster portfolio growth.

Whether you’re a seasoned property owner or just starting your journey, this guide will provide you with everything you need to know about DSCR loans: how they work, who can benefit, and why they might be the perfect fit for your investment strategy.

By the end of this article, you’ll understand the power of DSCR loans and gain actionable insights to leverage them for your real estate goals.

Table of Contents

What is a DSCR Loan?

A Debt Service Coverage Ratio (DSCR) loan is a specialized loan program tailored for real estate investors.

Unlike traditional loans, DSCR loans qualify borrowers based on the property’s rental income rather than the borrower’s personal income or financial documentation. The key requirement is that the property’s income sufficiently covers the mortgage payments.

Having worked with countless investors, I’ve seen firsthand how DSCR loans remove the barriers imposed by traditional financing methods.

By focusing solely on the property’s cash flow, DSCR loans make it easier for investors to qualify for financing, enabling them to scale their portfolios without the constraints of personal income verification.

This innovative approach simplifies the process and makes DSCR loans an ideal choice for:

✅ Investors who want to separate personal finances from their investments.

✅ Borrowers looking for a streamlined approval process without extensive documentation.

✅ First-time buyers, seasoned investors, and foreign nationals alike.

While DSCR loans are gaining popularity, many people—including industry professionals—are unfamiliar with how they work and how to calculate the DSCR.

Let’s break it down step by step.

How Do DSCR Loans Work?

Understanding how DSCR (Debt Service Coverage Ratio) loans operate is crucial for real estate investors seeking financing options prioritizing a property’s rental income over personal income verification.

Here’s an overview of how DSCR loans function:

1. Property Income Assessment

Unlike traditional loans that heavily depend on personal income documentation, DSCR loans focus on the property’s income-generating potential. This approach allows investors to qualify based on the property’s cash flow rather than individual financial statements.

2. DSCR Calculation

The Debt Service Coverage Ratio (DSCR) is the key metric used in DSCR loans to measure whether a property generates enough income to cover its debt obligations.

The formula is straightforward:

DSCR Calculation:

⚠️ Net Operating Income (NOI), Capitalization Rate (Cap Rate), Cash on Cash Return (COCR), and Return on Investment (ROI) are not factors considered in qualifying for a DSCR mortgage loan. These metrics, while essential for evaluating property performance and investment potential, do not impact the eligibility criteria for DSCR loans, which focus solely on the property’s income relative to its debt obligations.

Example of DSCR Calculation:

If your property generates $72,000 in annual rental income and your total annual PITIA is $60,000:

DSCR: $72,000 / $60,000

DSCR = 1.2

This means the property generates 20% more income than is needed to cover its debt, a positive indicator for lenders.

Why It Matters: A DSCR greater than 1 signals positive cash flow, which increases your chances of loan approval. HomeAbroad simplifies this process by offering expert guidance tailored to your investment goals.

At HomeAbroad, we simplify DSCR calculation with tools like our DSCR calculator. These tools help you determine your property’s eligibility and set clear financial goals.

3. Qualification Criteria

Lenders typically prefer a DSCR of 1 or higher, signifying that the property’s rental income sufficiently covers its debt.

However, HomeAbroad offers flexible financing options for properties with DSCRs below 1 (no-ratio DSCR). This flexibility ensures that diverse investment needs are accommodated.

At HomeAbroad, we offer DSCR at best terms if your DSCR Ratio is one or above. However, we also offer DSCR Loan at a ratio below 1, but with a higher down payment.

4. Streamlined Application Process

The application process for DSCR loans is designed to be efficient. Less emphasis is placed on personal income verification and more on property performance, resulting in faster approvals and a more straightforward path to securing financing.

By focusing on the property’s income potential, DSCR loans provide a viable alternative for investors who may not meet the stringent requirements of traditional financing methods.

At HomeAbroad, we are committed to offering tailored solutions that support your unique investment strategies.

Many of our clients come to us thinking they’re limited by traditional loan requirements. Once we introduce them to DSCR loans and how we calculate the DSCR, it’s a game-changer. These loans make it easier for investors to focus on cash flow and grow their portfolios.

Rachel Spaccarotelli, Sr. Customer Loan Manager, HomeAbroad

Our expertise ensures that every local or international investor can fully utilize DSCR loans to achieve their financial goals.

How Can You Qualify for HomeAbroad’s DSCR Loan? The Requirements

At HomeAbroad, we’ve tailored our DSCR loan requirements to provide flexible financing solutions for foreign investors.

Whether you are purchasing your first property or expanding your portfolio, our tailored criteria ensure that qualifying is straightforward and efficient.

Criteria | Foreign Nationals |

|---|---|

DSCR Ratio | >= 1 for best terms, <1 eligible with higher down payment |

Credit Score | No US credit history required |

Down Payment | 25% |

Loan-to-Value (LTV) | Up to 75% for purchase/refinance Up to 70% for cash-out refinance |

Cash Reserves | 6 months |

Property Use | Investment properties (residential and commercial) |

Loan Amount | $75K – $10M |

⚠️ HomeAbroad’s No Ratio DSCR allows financing for properties with a DSCR less than 1, but with a higher down payment. These loans are perfect for properties that are not yet generating rental income or are in transition, focusing on the potential future cash flow.

A Quick 7-Step Guide to Applying for a DSCR Loan

1. Get Started with HomeAbroad

Choosing the right DSCR loan lender is crucial. HomeAbroad specializes in DSCR loans, and we offer tailored loan terms to maximize your investment returns.

With our proven track record of working with investors and our expertise in DSCR loans, we are committed to helping you achieve your real estate investment goals. Begin your DSCR loan journey with us.

Not sure about us? Liam and Emma can vouch for us:

Despite having no US credit history, they guided us to the perfect DSCR loan, allowing us to invest in a stunning property in Lahaina. The process was smooth, and the rental income is covering our mortgage. We couldn’t be happier with their expert support and highly recommend them to any foreign national looking to invest in the US.

Liam and Emma – Canadian Investor – Purchased a rental property in Hawaii.

You can read about Liam and Emma’s home-buying journey here.

2. Meet with Our Mortgage Officers

After you submit your details, our dedicated mortgage officer will promptly contact you and guide you through every step of the process.

At HomeAbroad, we prioritize your investment success and are dedicated to providing personalized support tailored to your needs.

3. Get Preapproval

Submit basic financial information to get preapproved for a DSCR loan. This will give you an idea of how much you can borrow based on your available assets for a down payment, reserves, and expected closing costs.

4. Gather Your Documents and Fill Out an Application

Collect necessary documents, including rental agreements, financial statements, and property details, and complete the loan application.

Required Documents for DSCR Loans:

- Property’s purchase contract

- 2 Months’ Bank Statements

- Appraisal

- 1007 Rent Schedule

- Homeowners Insurance

- Entity Documentation (If buying under LLC)

5. Underwriting

The underwriter will thoroughly evaluate your application and supporting documents, following the lending guidelines, before making the final decision.

6. Approval

The underwriter will approve, decline, or accept your loan application with conditions.

7. Closing

After approval, our loan officer will provide a closing disclosure containing your final loan terms, monthly mortgage payment schedule, and closing costs you should pay on closing day. Accept it, complete the necessary paperwork to get the funds, and take property ownership.

Following these steps and meeting the outlined criteria, you can qualify for a DSCR loan and leverage its benefits to grow your real estate investment portfolio.

Pros and Cons of DSCR Loans

DSCR loans provide a unique financing option tailored specifically for real estate investors. Based on my experience working with a wide range of clients, the advantages and potential drawbacks of DSCR loans help you make an informed decision.

| PROS | CONS |

|---|---|

| ✅ No Personal Income Verification | ❌Higher Interest Rates |

| ✅ Get Multiple DSCR Loans Simultaneously | ❌ Larger Down Payments |

| ✅ Fast and Streamlined Process | ❌ Additional Closing Costs |

| ✅ Flexible Loan Options | ❌ Risk with Low Cash Flow |

| ✅ Cash-Out and Refinance Options | |

| ✅ Versatility in Property Use |

Pros of DSCR Loans

✅ No Personal Income Verification

One of the most significant advantages of DSCR loans is their focus on the property’s rental income rather than the borrower’s personal income. Investors with complex financial situations or no W-2s can still qualify, making these loans highly accessible.

✅ Get Multiple DSCR Loans Simultaneously

With no debt-to-income (DTI) ratio restrictions, investors can secure financing for multiple properties simultaneously, making portfolio expansion easier.

✅ Fast and Streamlined Process

The approval process is faster since lenders focus on the property’s performance, reducing the need for extensive documentation and personal financial scrutiny.

✅ Flexible Loan Options

DSCR loans accommodate a range of scenarios, including low DSCR ratios (0–0.99) or properties with no current rental income, making them ideal for transitional properties.

✅ Cash-out and Refinance Options

Quickly refinance existing properties or tap into built-up equity through cash-out refinancing to fund additional investments or renovations.

✅ Versatility in Property Use

DSCR loans can be used for various properties, including single-family rentals, multi-family units, and short-term vacation rentals like Airbnb.

Cons of DSCR Loans

❌ Higher Interest Rates

Since DSCR loans are considered non-QM (non-qualified mortgages), they often carry higher interest rates than traditional loans. This is a tradeoff for their flexibility and accessibility.

❌ Larger Down Payments

Typically, DSCR loans require a down payment of 20–25%, which might be a barrier for first-time investors or those with limited capital.

❌ Additional Closing Costs

Origination fees and other closing costs may be slightly higher for DSCR loans than conventional financing, reflecting their unique benefits.

❌ Risk with Low Cash Flow

Repayment risks may increase for properties with lower DSCR ratios or inconsistent rental income, especially during periods of high vacancy or unexpected expenses.

DSCR Loan Success Story: How a UK Investor Achieved Their US Real Estate Goals

Over my years working with international investors, I’ve seen firsthand the unique challenges they face when entering the US real estate market. However, at HomeAbroad, we specialize in turning these challenges into opportunities.

One such success story is that of a UK investor who secured a DSCR loan to purchase a rental property in Florida.

This case perfectly highlights how tailored solutions, expert guidance, and a deep understanding of DSCR loan flexibility can make all the difference for foreign investors.

Overview:

Client Profile

Name: Sam Smith (name changed for privacy)

Background: A UK citizen on an L1 visa with less than six months in the US and no US credit history.

Objective: Purchase a $500,000 rental property in Sarasota, Florida, to generate steady cash flow and build a US real estate portfolio.

Challenges

⚠️ No US Credit History: Sam faced multiple rejections from traditional lenders due to their lack of a US credit score, a common obstacle for foreign nationals.

⚠️ Low DSCR: The rental property had a DSCR below 1, which typically disqualifies it for traditional DSCR loan programs.

⚠️ Understanding US Financing Requirements: As a foreign national, Sam was unfamiliar with the US loan application process and documentation requirements.

The HomeAbroad Solution

HomeAbroad’s expert mortgage officer, Steven Glick, tailored the DSCR loan program to craft a perfect solution ideally suited to Sam’s needs:

✅ Identifying the Right Loan Program

Recognizing the limitations of traditional lenders, our mortgage officer, Steven Glick, recommended a no-ratio DSCR loan, which does not require a specific DSCR for approval.

✅ Customizing the Process

Steven simplified the application process for Sam by guiding them through every step, including understanding property performance metrics and submitting essential documents.

✅ Efficient Underwriting

Despite the property’s low DSCR and Sam’s lack of credit history, our tailored approach ensured a smooth underwriting process, culminating in loan approval within 29 days.

The Outcome

With HomeAbroad’s support, Sam successfully purchased the $500,000 rental property under an LLC and secured the following loan terms:

✅ Loan Amount: $341,000

✅ Loan Type: No-ratio DSCR loan

✅ Time to Close: 29 days

Sam is now generating rental income from the property, laying the foundation for an expanding US real estate portfolio.

Why This Case Matters

This success story underscores the flexibility and power of DSCR loans, particularly for foreign nationals. At HomeAbroad, our expertise working with international clients ensures that challenges like a lack of US credit history or low DSCR don’t hinder your investment goals.

Ready to achieve similar success?

Read the case study here: How a UK Investor Secured a DSCR Loan.

Get a DSCR Loan with HomeAbroad

DSCR loans have revolutionized real estate financing by eliminating the hurdles of traditional loan requirements.

With over 10 years of experience helping investors use this financing tool, I can confidently say that DSCR loans are the ultimate solution for scalable and flexible investments.

At HomeAbroad Loans, we pride ourselves on being at the forefront of DSCR lending. Our expertise in crafting tailored solutions ensures that clients achieve their unique goals.

Ready to take your investments to the next level? Contact us today, and let our experts guide you every step of the way.

FAQs

Can I use future rental income to qualify for a DSCR loan?

If the property is not currently rented, we can use the appraised market rent value to calculate the DSCR. This is particularly useful for newly acquired properties or those undergoing transition. However, documentation such as a rental market analysis or appraisal report will be required.

Can you qualify for a DSCR loan with a DSCR less than 1?

HomeAbroad offers a DSCR Loan even if your DSCR ratio is less than 1. However, you would need to make a higher down payment.

Are there any restrictions on the types of properties I can finance with a DSCR loan?

DSCR loans are highly versatile and can be used to finance a variety of properties, including:

✅ Single-family homes

✅ Multi-family units

✅ Short-term rentals such as Airbnb and Vrbo

However, properties must be intended for investment purposes, not primary residences or second homes.Can you refinance with DSCR loans?

Yes, you can refinance with DSCR loans. These loans allow investors to refinance existing investment properties based on their income potential.

![DSCR Loans: What It Is & How to Apply in [2026]](https://homeabroadloans.com/wp-content/uploads/2025/02/DSCRLoans-500x325.jpg)